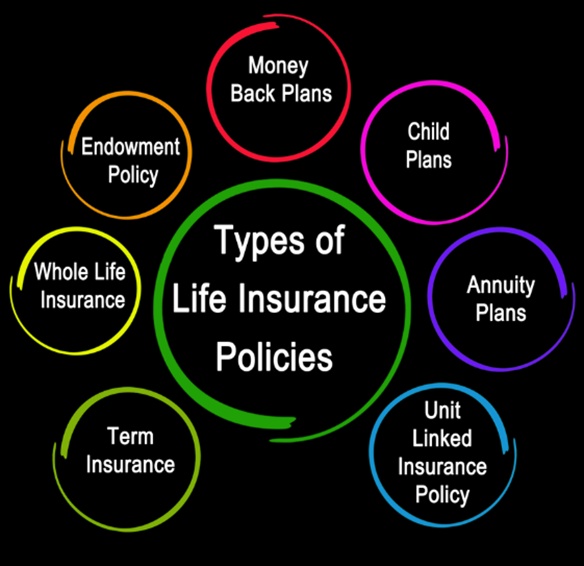

As the name suggests, Life Insurance India secures your life from financial losses, which occurred due to the unexpected or premature death of the insurer. In life insurance, the insurer pays a fixed amount of money in the form of premium, to the insurance company.

In return for which company promises to pay a certain sum of money to the family or legal heir of the insurer, on his death or mis-happening. The money the company pays depends upon the contract and premium paid by the insurer. Call us now, your Life Insurance Agent to ensure you and your beloved family.

You will do anything for the ones you love. Thinking about why you need Life insurance can be an emotional and stressful task. However, life insurance is one of the most responsible decisions you can make to help ensure that your spouse, children or other loved ones can continue to enjoy the quality of the life they deserve.